« In the N.O. Episode 40: Pelicans 2019 Free Agency Primer

Pace vs Transition »

Structuring The Al Horford Deal

Introduction:

At this point there is enough smoke around the Pelicans and Al Horford that this warrants a post. The purpose of this post is to flesh out potential structures for the Al Horford deal. I wish I had the time to make this witty or tell a compelling story about how signing Horford symbolizes some greater plan the Pelicans have in place, but alas free agency is upon us and someone else can tell that story. I’m going to stick to the facts as closely as I can so forgive me if this is a bit more rigid than previous pieces.

The “Facts”:

Al Horford declined a $30.1M player option with the Boston Celtics. He was reported to be seeking a 4 year deal to the tune of $112M. Many speculated that some mystery team already has this offer out for him (more on this later). The Pelicans are a team that have been linked, unlinked, and then linked again to Al Horford. The Pelicans currently sit on around $32,240,141 of cap space with the ability to increase this amount by waiving some non-guaranteed contracts. Outside of cap space, the Pelicans have a $4,761,000 room exception available to them to improve the roster. Other ways for the Pelicans to increase the amount of cap space available is by stretching or trading players – like E’Twaun Moore.

The Assumptions:

The first assumption is the Pelicans are actually interested in bringing in Al Horford – just not for the years and price he wants. The basketball fit and locker room presence makes entirely too much sense for this not to be true. If you need me to explain this to you, go watch some highlights or something.

The second assumption is that the 4 year, $112M offer by a mystery team is not a real one. Now this is a bigger leap than the first assumption, but allow me to explain. First, let’s talk about the $112M number. Over 4 years, this comes out to on average $28M per year – the rough cap figure available to teams like Dallas and New Orleans (New Orleans did not tender qualifying offers to Cheick Diallo and Stanley Johnson and thus have increased their amount from $28M since the initial Horford reports started). Secondly, if you take Al Horfod’s $30.1M player option and extrapolate that out over 4 years, with a 5% decline year over year, that number comes out to $111.67M – which rounded up becomes $112M. Seems to be too good of a coincidence to be true.

To me this screams agent speak. Things didn’t work out in Boston for one reason or another. It’s entirely possible that Boston had their eyes on Kemba this entire time and were not serious in their negotiations with Horford. In any case, setting the bar at 4 years, $112M alerts a league flush with cap space of Horford’s price tag. Glushon Sports Management, Horford’s agency, isn’t new to broadcasting their client’s value across the airwaves. The Pelicans endured a similar situation during Jrue Holiday’s free agency, with Jrue being linked to big money from basically any team that had the cap space. Jrue finally settled on a 5 year, less than max but incentive heavy deal with the Pelicans. Note this for later.

The third assumption is that Nikola Vucevic securing a 4 year, $90M deal from Orlando actually sets the market for Horford. Vucevic is 6 years younger than Horford, and many might say a better player at this stage of their careers. The average annual value for Vucevic comes out to $22.5M per year. Even for the best agents, it will be difficult to convince a front office to cough up more money for Horford than it cost to secure Vucevic for the duration of his prime. (After the publishing of this article it was reported Vucevic actually agreed to a 4 year, $100M deal. The point still stands, Vucevic was secured more cheaply than what Horford is asking. We have yet to know if there are any incentives in Vucevic’s deal.)

The final assumption is that no Horford deal will exceed the salary of Jrue Holiday. Salary plays an interesting role in locker room dynamics. David Griffin and the Pelicans have gone above and beyond to reinforce the idea that this is Jrue’s team. It then reasonably follows he will be the highest paid player on the Pelicans next year. Jrue is slated to earn $26,231,111 this coming year.

Deal Structures:

The Fully Guaranteed Approach

The easiest possible deal to construct that satisfies the assumptions above is a 3 year, $78M fully guaranteed deal. The AAV for this deal comes out to $26M, which satisfies the Jrue clause, and can begin at $24,761,900 with 5% annual raises. Such a deal would leave the Pelicans with ~$7,478,241.00 in cap space to work with in addition to the room exception listed above. The Pelicans can likely land 2 solid, but not great, free agents with the available options. This structure is fine, clean, and gets the job done. But I’m greedy, I want the Pelicans to have more flexibility.

The Incentivized Approach

Remember when I asked you make a mental note of Jrue’s incentive laden deal? Well my approach with Horford would be a similar one. Here is the meat of the deal: 3 Years, $67.7M guaranteed + $10.2M in unlikely incentives, $77.9M total value (More on why this is a slightly lower value later).

The total value of this deal is extremely similar to the fully guaranteed approach, but the guaranteed portion is about $10M lower. To fully understand the benefits of this approach, you need to understand how incentives work. Incentives, or bonuses can be categorized as either likely or unlikely. The incentive is deemed likely or unlikely to be achieved based on whether the criterion was achieved in the previous season. For example, Al Horford played 68 games last year. If the Pelicans placed a game played incentive in his contract and set the value at 69 games, this would be deemed an “unlikely” bonus. Unlikely bonuses also have the added benefit of not being included in the player’s cap hit. The team must have enough cap room to sign the total value of the contract + incentive for it to be legal, but once the contract is signed, the bonus portion of it is no longer counted towards cap space. Read this excellent article by Albert Nahmad on how Miami manipulated incentives to lower their cap number a few years back.

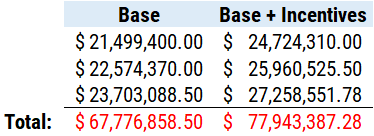

One thing to note is that the CBA limits unlikely bonuses to 15% of the base salary in each season of the contract at the time of signing. Given this information, the Al Horford contract could be structured as such:

Now because “unlikely” incentives do not count against the cap, only the $21.5M base would apply the first year. This would leave the Pelicans with $10,740,741 in cap space for the year in addition to the room exception. With $10.7M, the Pelicans could then re-employ the unlikely incentive approach to the next free agent they sign, making their first year potentially worth $12,351,852 despite only counting for the $10.7M figure in cap space. Extrapolate this value over 3 years, and is that enough to get you a Danny Green or Terrence Ross? It’s possible.

But I chose these specific numbers for a reason. You see, the $10,740,741 corresponds exactly with the salary of one Andre Roberson. I was looking around the league for teams that may be in a difficult situation with the tax and have the need to dump players. Andre Roberson and OKC fit rather cleanly here. Other candidates I considered with this approach were Robert Covington, should Minnesota need to open space for D’Angelo Russell, or Jerami Grant. All three of these players are in the $9.5M – $11.5M salary range, and would keep Horford’s base salary between $20M – $22M range and overall contract value between $76M – $78M. There are probably a few other players that fit this range, but I will leave you to find them.

Cautions:

Incentives are not free money, and nor are they free cap space. For starters, a player has to agree to them. If a player finds the “unlikely” incentives, well, unlikely, then there is no reason for them to agree to them. However, a player can be coaxed into thinking that they are a fairly realistic possibility. The Pelicans can approach this in at least two ways. The first structuring the performance bonus entirely around games played. As mentioned earlier, Horford played 68 games last season. If the bonus criteria is 69 games played, the Pelicans can and need to be selling Aaron Nelson and his staff. They need to sell the $5M+ investments made towards upgrading facilities, as well as the partnership with Fusionetics. Come here, and we’ll keep you healthy.

Obviously nothing is guaranteed with health, so the Pelicans can offer to split the incentive and offer one for making the playoffs. Because the Pelicans missed the playoffs the previous year, any player signing with them would be deemed “unlikely” for making the playoffs this year. It’s safe to say both sides here are motivated towards making the playoffs so this may be an amenable term.

Another thing to consider is that ALL incentives count towards the hard cap. The Pelicans, at the moment, have a considerable amount of breathing room underneath the tax line and apron and therefore should not have to worry about the hard cap this year. However, in future years it can very much be a concern that makes some moves difficult to maneuver. The Pelicans were put in this situation not too long ago as Jrue’s incentives brushed them right up against the hard cap in 2018. With Ingram entering restricted free agency next year, and Ball the following year, the Pelicans definitely have to be mindful of the money they are committing long term.

Lastly, it is still possible that Horford wants a 4th year. There will likely be some haggling about this and ultimately may lead to negotiations falling apart. It happens. There are partial guarantee structures or team options that can be placed here that might make for a compromise for both sides, but it very well could be a sticking point. There are other mutually beneficial sweeteners the Pelicans can toss in depending on the situation such as signing bonuses, or offering to front-load the deal if the Pelicans miss out on a free agent target. It will be a complex dance. Who knows what will happen. Maybe there really is a mystery team out there willing to commit the full $112M.

One Comment